|

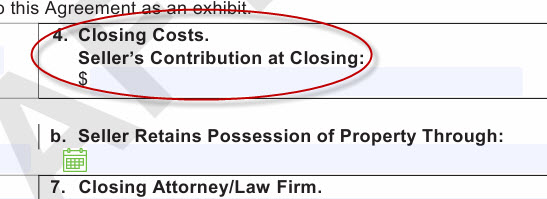

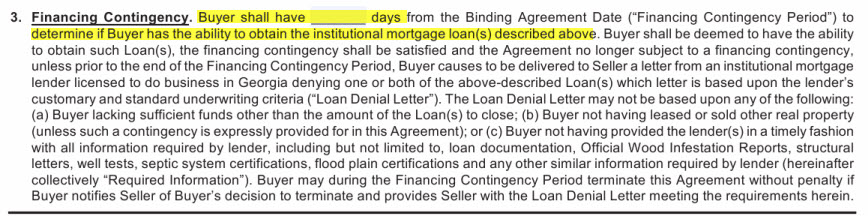

Page 1, 4. Closing

Costs. Seller's Contributions at Closing

This is where you can

have the seller pay some of the closing costs.

The contract is written so that the buyer is responsible for all

the costs of the transaction except for the realtor commissions

and some of the transfer taxes.

You have to state a specific

amount. If closing costs are less than that amount, the

buyer doesn't get any refund so you should know upfront from you

lender how much to expect in closing costs. Closing costs

include discount points that are used to lower the interest

rate.

The seller doesn't

actually write a separate check for these items. They are deducted

from their side of the balance sheet which results in them

walking away with less.

The seller is mainly concerned about

their bottom line, the amount that they walk away with.

Don't get too bogged down on the specifics of who pays what.

All that really matters is the net amount. The seller is

just going to add up all of the costs that they need to pay and

look at what they are left with.

An offer of $400,000 with the

seller paying $5,000 in closing costs is the same to the seller

as an offer for $395,000 with them paying zero closing costs.

Therefore, if you really

think it through, the buyer is paying for everything one way or

another. Having the seller pay closing costs just means

that the price will be higher and therefore the amount financed

will be higher and therefore the Buyer will in fact be financing

those closing costs over the length of the mortgage.

If you ask the seller to pay

some of the closing costs, that leaves more money in the pocket

of the buyer. But the Buyer has a higher monthly payment.

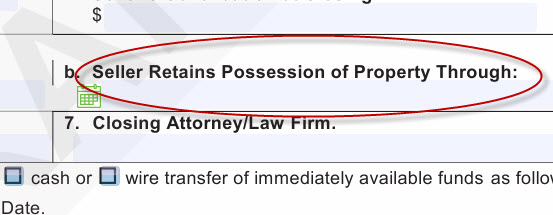

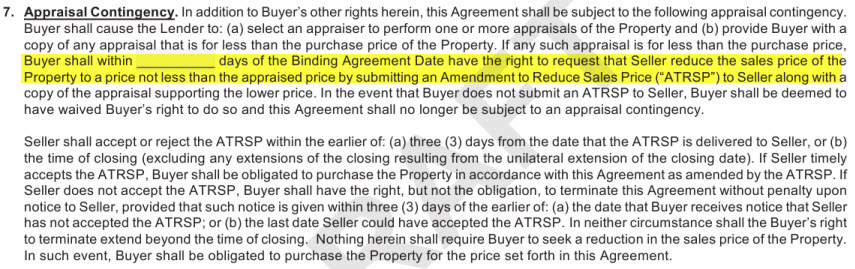

Page 1, 5.b.

Possession After Closing

The best situation for the

Buyer is to take possession immediately after closing. Just

before the closing, you do a final walk-thru with the property empty.

This allows you to know exactly what you are getting before you sign off on

all the paperwork. If there was any damage done during the

move out process, you can deal with it at the closing or refuse

to close.

In Georgia, it is customary

in many cases to do the closing and then allow the seller up to 48

hours to move out before handing over possession to the Buyer. The seller

doesn't want to have all of their possessions on a moving truck

and then find out at the last minute something went wrong with

the buyer's financing.

The negative aspect of

giving the seller a few days to move out after the closing is

that the buyer takes the risk that damage might occur during the

move out and then they aren't in much of a position to do anything

about it.

If it's something that the

seller is insisting on to make the deal happen, then you want to

make sure you include the

"Temporary Occupancy Agreement" that

spells out the details of who is responsible for certain things.

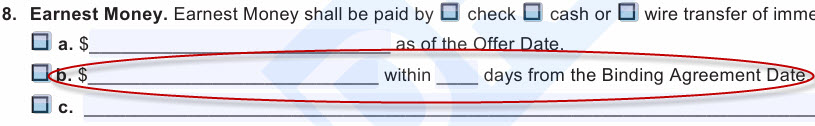

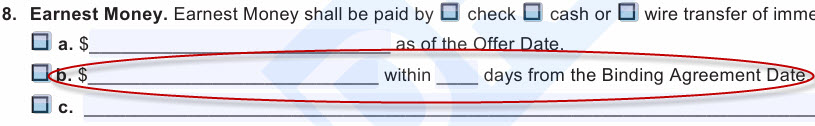

Page 1, 8. Earnest

Money

Earnest money is the deposit

you put up front showing that you are "earnest". It's the

amount of money that you will forfeit if you default on the

contract.

Usually 1% of the

purchase price is a reasonable amount. So on a $300,000 home,

earnest money would be around $3000.

The higher your earnest

money, the stronger your offer might look. If you just put

up $500 earnest money, that won't give the seller much

confidence. That means that if you walk away they only

would get $500 for having their home off the market during that

time.

If the closing date will be

more than 45 days in the future, the seller will usually want

more earnest money. This is because the seller will be

losing a lot of potential buyers during that time when their

home will be off the market.

Earnest money isn't deposited

until after the binding agreement date. It's usually held

in the buyer agent's broker's escrow account. The buyer

does not get interest on it.

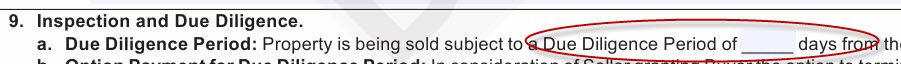

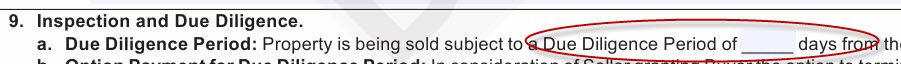

Page 1 9. Inspection

and Due Diligence

The Due Diligence Period is

the time period during which the

Buyer can do any inspections or research to decide whether they

want to actually buy the property. It starts on the

Binding Agreement Date.

Before the end of the Due

Diligence Period, the Buyer can try to negotiate an "Amendment

to Address Concerns". This is where you can request

the seller to fix certain items before closing or maybe adjust

the purchase price or seller paid closing costs in lieu of

repairs. Or the Buyer can decide to terminate the contract

by sending

a

Termination and Release Notification to the seller before the end of the Due

Diligence Period.

The days of the Due Diligence

Period are full days and it ends at midnight of the last day.

Therefore, a contract signed on Monday at 3pm with a two day due

diligence period would give the buyer until midnight on

Wednesday.

The length of the Due

Diligence Period is negotiable. A usual compromise is

between 7-14 days.

Remember, the seller doesn't

really have a solid contract until this period is over because

the Buyer can terminate for any or no reason at all. So

trying to get a 21 day due diligence period is going to be very

difficult.

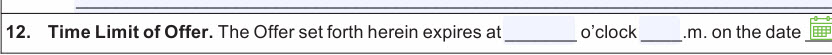

Page 1, 12.

Time Limit of Offer

You can try to convey some

urgency by putting a time limit on the offer. Then for a

valid binding contract, the seller needs to sign off on everything

before that time limit.

If for some reason the seller

sends back the signed contract but it's a few minutes past the

time limit, then you don't have a binding contract. The buyer has to change that time limit of

offer, initial, and send it back to the seller for their

initials at the changed time limit of offer. You don't

have a binding agreement until the seller sends it back again.

This means that there's a chance that another offer can come in

and mess things up for you.

So be careful. Trying to

quickly bind down a home by putting in a really short time limit

of offer can sometimes backfire.

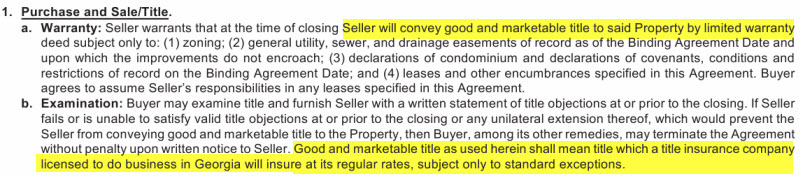

Page 2, B. 1.

Warranty

The title search is done by

the closing attorney. They usually wait until after the

due diligence period is over because it costs them money to hire

someone to do the title search.

Title issues are fairly rare

but once in a while there are issues with paid off mortgages that

haven't been recorded as satisfied or other technical problems.

The title search finds any

liens attached to the home. Sometimes an HOA might have a

lien for unpaid dues. Any of these items have to be taken

care of by the seller before title can be transferred.

Page 2, 3. Method of

Payment

Just about every closing

attorney requires the funds to be wired to their escrow account

before closing. Cashiers checks aren't used anymore due to

problems that have occurred in the past with fraud.

If you wire too little, usually a personal check for

amounts less than $500 will be accepted.

If you wire too much money,

the closing attorney cuts you a check for the overage at

closing.

Wires aren't immediate.

They sometimes can take several hours to go through so you need

to plan accordingly.

Page 2, 4.

Closing Costs and Prorations

Unused Seller's Monetary

Contributions remain with the seller so make sure you don't ask

for more closing costs than you'll be able to use.

Many times the property

tax prorations have to be based on last year's tax bill because

the tax bill for the current year isn't available at the time of

closing. All parties agree

that if the actual tax bill is different, both parties will

correct the prorations accordingly.

Remember that taxes are

paid for the entire calendar year sometime in October. So

if you close in August, the seller will pay you the property

taxes for January thru August and then you will pay the entire

tax bill for the year in October. If you have a mortgage

that escrows for taxes and insurance, you will be required to

pre-fund that escrow account so that there will be enough to pay

the taxes come October.

Again, there aren't

separate checks for these specific items. It's all

balanced out on the closing sheet with credits and debits.

Page 2. 5.a. Right to

Extend Closing Date

If your lender can't get

the loan closed in time you can unilaterally extend the closing

date by up to 8 days. But the delay can't have been due to

something that the Buyer did or didn't do.

If the seller needs more

time to clear something on the title, they also can unilaterally

extend the closing date.

Since all parties are

making their respective plans based on the contracted closing

date, you want to do everything possible to get it closed on the

agreed upon date. Use this clause only as a last resort.

Both parties can also

agree at any time to an amendment to extend the closing.

Page 2. 5.b. Keys and

Openers

Page 2. 7. Closing

Attorney

When a mortgage is

involved, the closing attorney represents the lender. The

lender will send over "The Package" to the closing attorney at

least 4 days before closing. From these instructions, the

lender prepares all of the paperwork that the lender requires to

be signed.

Page 3. 8. Earnest

Money

This details the process

of what happens if there is a dispute with how the earnest money

should be disbursed.

Usually if there is a

dispute, the broker will eventually send it to arbitration. The

loser pays costs.

I advise not having the

earnest money so large that it makes an attractive target to a

litigious party.

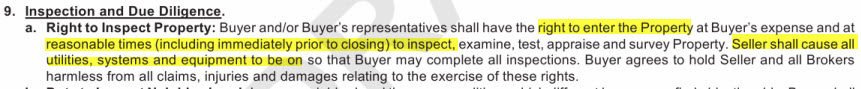

Page 3. 9.a. Right to

Inspect Property

You have the right to

inspect at "reasonable" times.

Try to have consideration

for the seller by trying get everything done on one day if

possible. If you need to take measurements or have

painters or contractors look at it, schedule them at the same

time.

Usually you set up an

inspection time that works for your schedule and then I will let

the listing agent know.

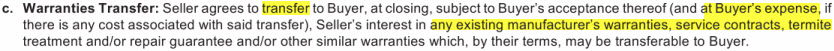

Page 3. 9.c.

Warranties Transfer

All warranties transfer

but if there is a cost involved in transferring a warranty, the

Buyer is responsible for it.

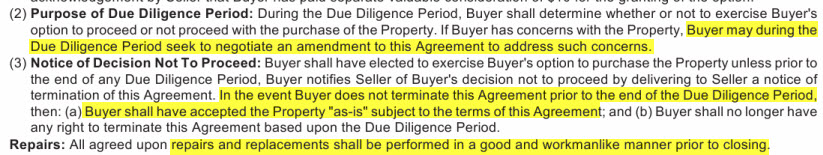

Page 3. 9.d and e.

Due Diligence and Repairs

You have until the end of

the Due Diligence Period to either negotiate an amendment to

address concerns or to terminate.

If you don't terminate,

the contract continues.

All repairs agreed to

shall be made in a good and workmanlike manner before closing.

You can have your

inspector check out the repairs before closing.

Since the way things get

done can be very subjective, it's best to either be very

specific on how the repairs shall be completed or better yet,

try to get a monetary concession so you can control exactly how

the work will get done by doing the repairs yourself after

closing.

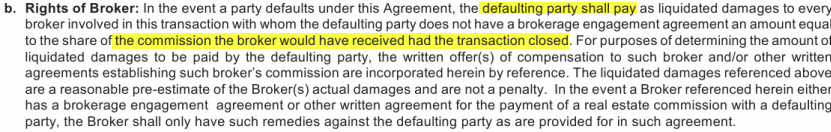

Page 4. 11. b.

Brokerage Commission in case of Default

This is very important to

understand. This clause gives the agents the right to sue

a defaulting party for the commission that they would have

received had the contract closed. Most of the time agents will not pursue a

defaulting party for the commission but you need to know

that this is possible.

As a buyer, if you back

out of the contract at the last minute outside of any other

specific contingency, you not only lose your earnest money but

your are liable to pay the whole commission. On a $500,000

home with a 6% commission that would be $30,000.

Page 4. 11.c.

Disclaimer

Agents might talk to you about

a lot of things but this just let's you know that they are not an

expert in many of these fields and you should seek expert advise

regarding things like termites or construction or taxes etc.

Page 5. 2. Default

You might ask, what if the

seller decides not to sell? This says that you can sue

them or take any other lawful remedy.

Page 5. 3. Condition

at Closing

The home should be in

substantially the same condition as on Binding Agreement Date

and it should be clean and free of trash and debris.

You might think it wise to

put in a special stipulation about having it professionally

cleaned or maybe having the carpets cleaned but then you get

into issues of just how clean is clean? There is clean and

then there is clean. Do you really want to set yourself up

for disappointment? I advise that you just plan on having

it cleaned to your specifications before you move in.

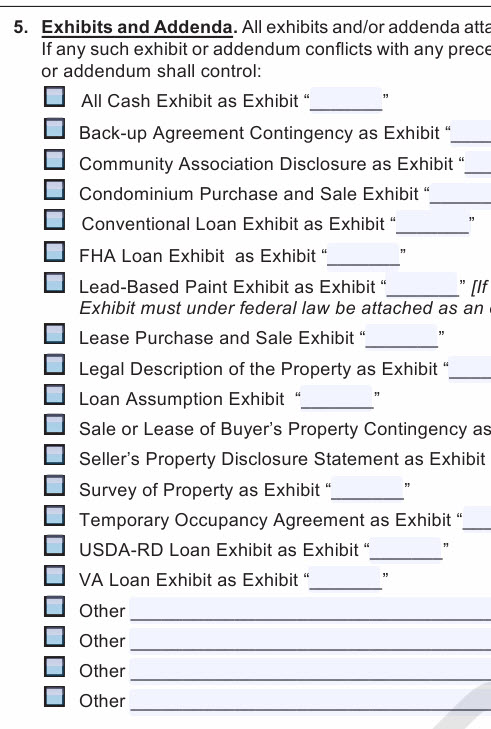

Page 6. 5. Exhibits

and Addenda

Anything can be attached

to the contract. This is just a list that reminds you of

the most often used exhibits.

The one that is usually

the most important is the

"Conventional Loan Exhibit" Click to download a copy.

Page 6. Special

Stipulations

This is where you can add

any special stipulations such as asking for the seller to

provide a termite bond.

If there is a conflict in

terms, the Special Stipulations control.

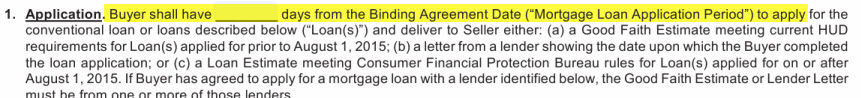

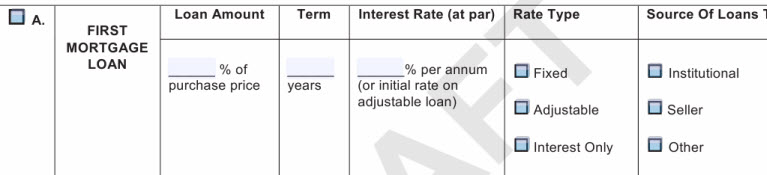

Finance Contingency

and Appraisal Contingency are in the

Conventional Loan Exhibit

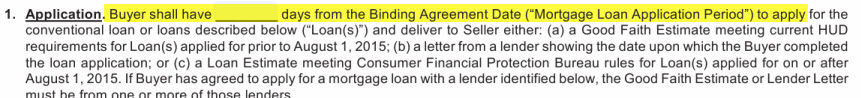

You agree to apply for a

loan within a certain number of days, usually around 3 days.

You just have to apply, not be approved in that initial time

frame.

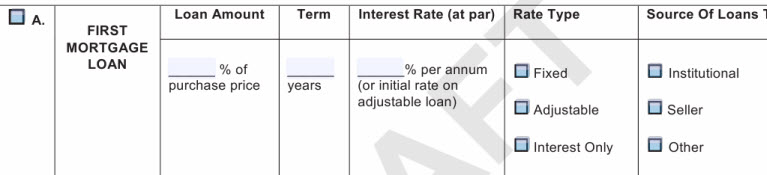

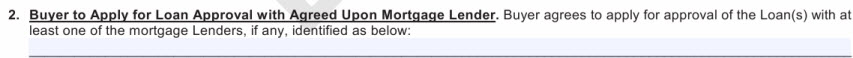

You need to specify the

type and terms of the loan and the specific lenders that you are

making the financing contingent on. You can get any other

type of loan or use any other lender but you can only terminate

the contract if you get denied for the loan you specify here and

it has to be by a lender that you have listed.

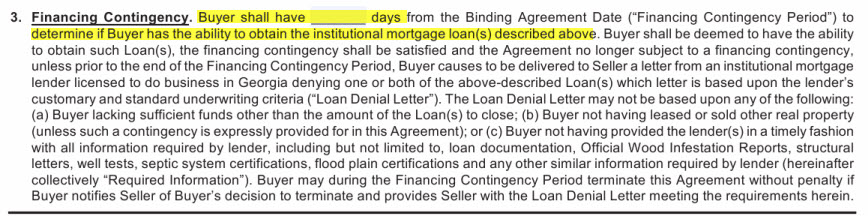

The length of the finance

contingency is negotiable. 28 days is a common length of

time. You don't need to have the loan completely approved

but if you have any doubts of being approved, you really ought

to get the lender to make sure they have final loan commitment

by this day.

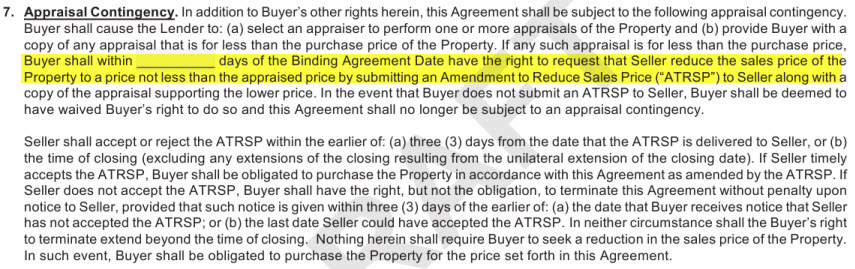

The appraisal contingency

is part of the Finance Contingency. Usually you make it

the same time or maybe a little shorter than the finance

contingency part.

This clause also spells

out the details of what happens if the appraisal comes in low.

If that happens, you can try to negotiate the price down.

If the seller doesn't agree to that, you can either terminate or

continue on to closing at the agreed upon price. The

lender will only loan money based on the appraised price so if

the appraisal is low than the purchase price, you will have to

come up with a larger down payment.

Most buyers wouldn't

consider paying more than the appraised price but sometimes

appraisers can be way off target. Appraisers aren't

perfect. Many times they don't know a specific area and

won't make adjustments for highly sought after school districts.

|