|

How to Use the "Maitski Line Reports" to

Get an Idea About Which Way Homes Prices Are Going

For years I have been putting out monthly price charts for single

family home prices in Atlanta.

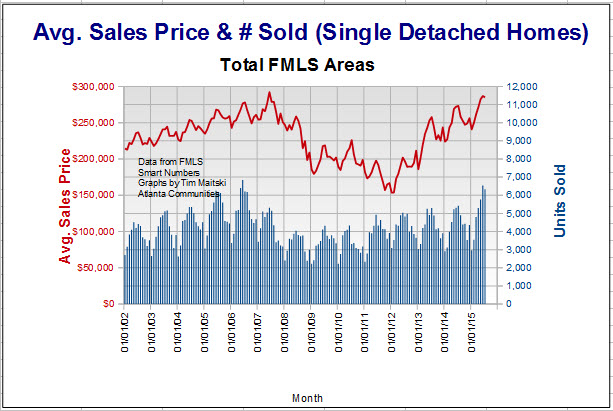

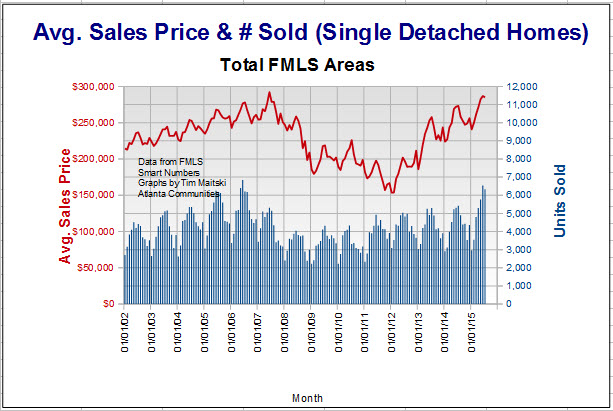

This chart shows the number of sales per month (demand) vs. the

price

It's nice to see what has happened

but it does nothing to predict the future of prices.

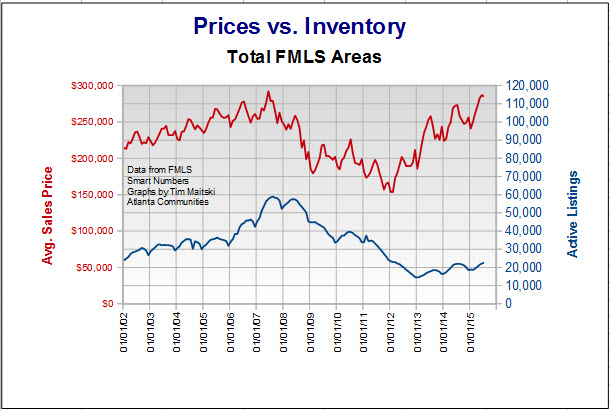

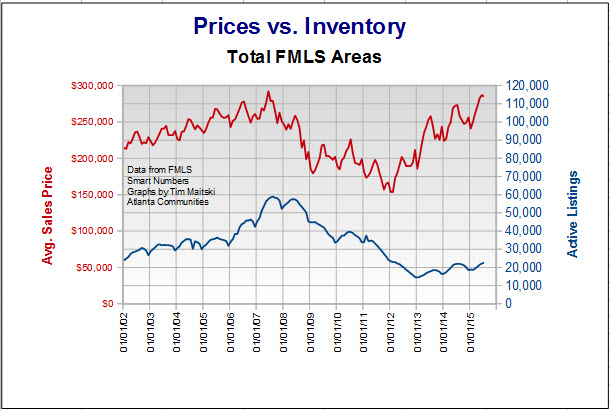

Then I began tracking the

inventory of single family detached homes (supply).

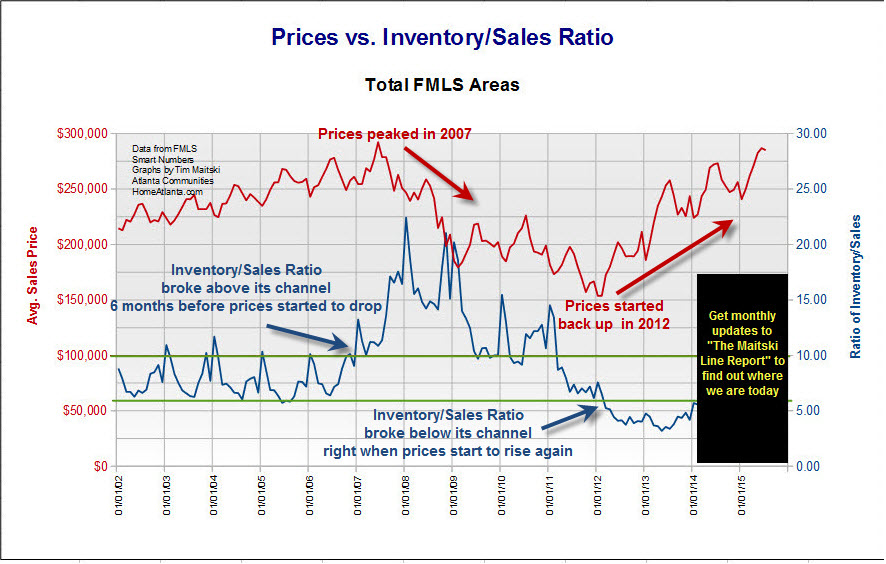

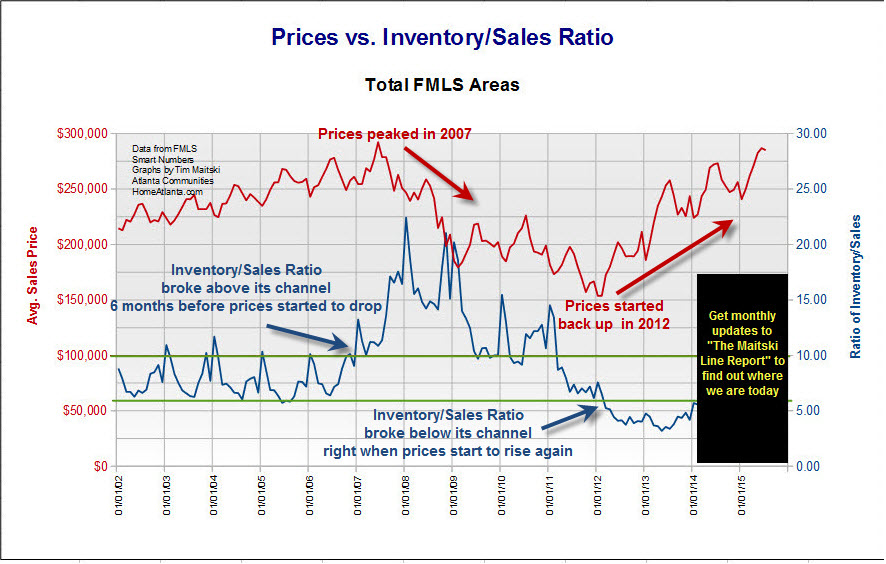

The key "aha moment" was when I took a look at the ratio of

inventory/sales. You can call it the supply/demand ratio

(Absorption rate). I divided the monthly inventory of homes by the monthly

number of sales and plotted it against the monthly sales prices.

I had never

seen a chart of absorption rates over any significant length of time plotted alongside

home prices.

Since we've had some of the most dramatic price

moves in Atlanta real estate over the past ten years, the thought

was that I might be

able to see how prices and absorption rate are correlated and

possibly see if it could be used as a leading indicator.

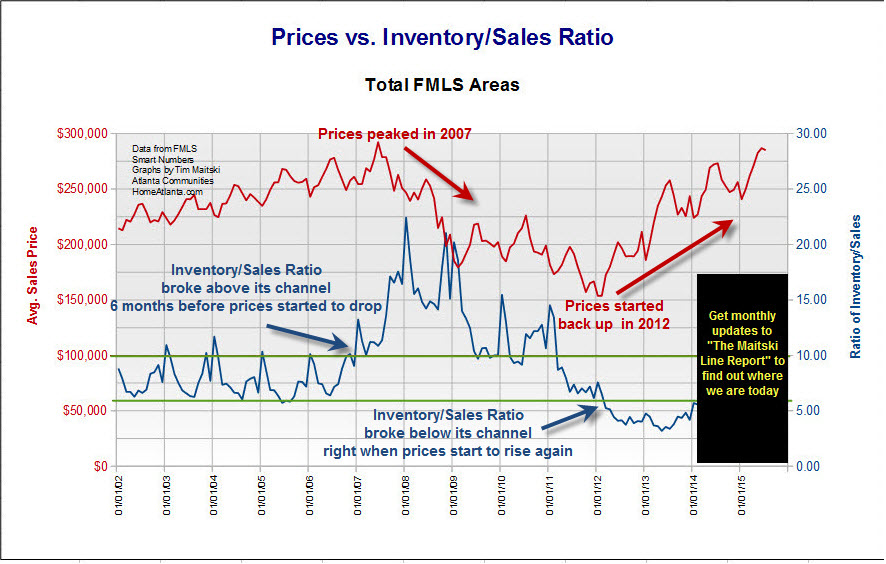

In the chart below, pay attention

the blue line (Inventory/Sales Ratio). When it stayed above

its historic range (between the two green lines), in 2007 prices soon fall.

When it fell below its historic range, in 2012 prices soon rose

dramatically.

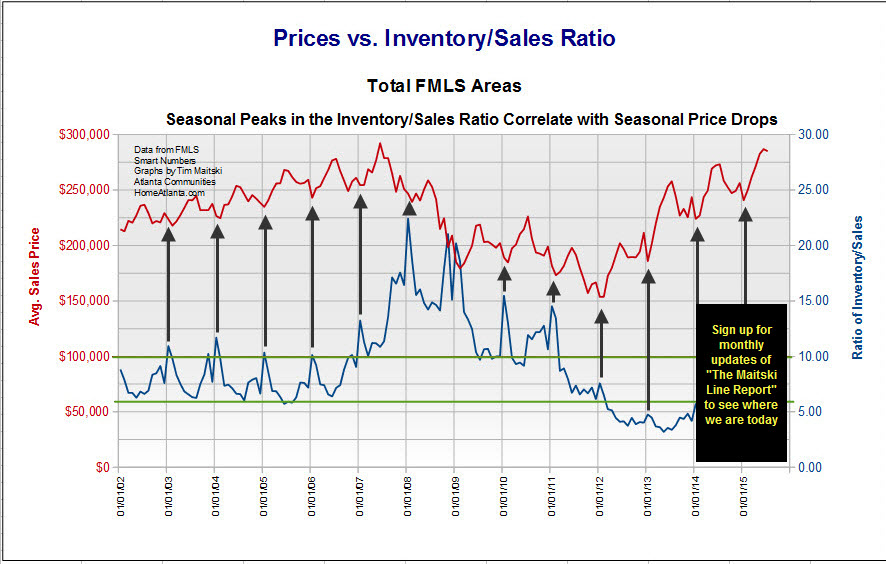

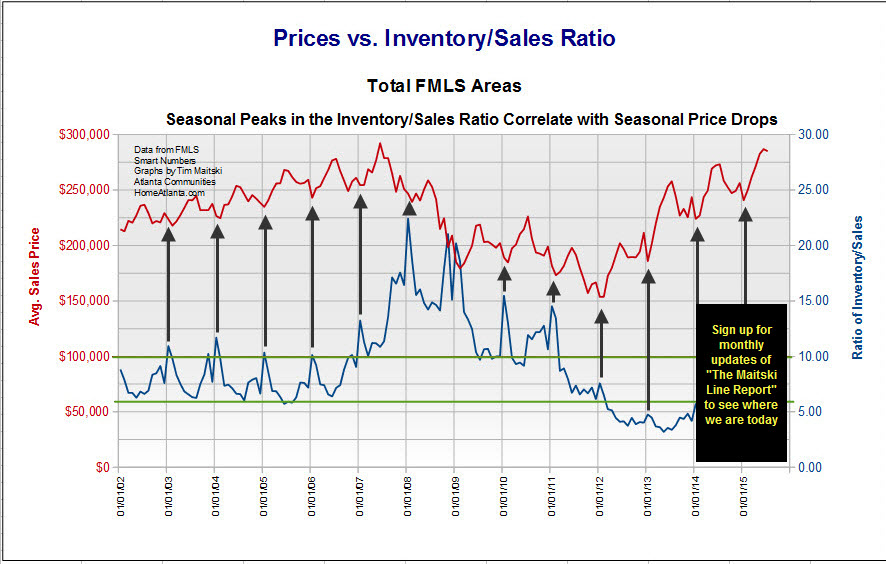

In the chart below, notice how the seasonal peaks and

valleys of the Inventory/Sales ratio (the blue line) corresponds with the seasonal

peaks and valleys of prices (the red line).

Every year in January, when the

inventory/sales ratio peaks (more supply than demand) prices seem to

be at their seasonal lows. When the tables turn in the summer

(low supply and high demand) prices are at their seasonal highs.

This is a picture of supply and demand in action. It validates the

correlation of this indicator to prices on a yearly

basis and therefore should correlate to the longer real estate

cycles. Taking advantage of these longer real estate cycles is

what we are really after. We all got a wake up call repeating

the mantra that real estate prices can only go up.

You can also see that the

inventory/sales ratio stayed in the fairly tight band, between 6 and

10, between 2002 to 2006. This was a time when prices in

Atlanta were rising steadily at about 4.5% per year.

Look at what happened when that ratio went above 10 and

kept going up in the spring of 2007. 6-12 months later prices

started to fall. There was too much supply and not enough

demand and therefore prices started to adjust. Real estate isn't liquid

like stocks and bonds. It takes months instead of seconds for

prices to adjust. Therefore you have some time to take

advantage of the information.

Prices kept falling until the

inventory/sales ratio fell to below 6 in the spring of 2012.

Since then, the inventory/sales ratio has been below six and prices

have risen by 52% from their lows. Supply is low while demand

is high and therefore the prices have adjusted higher.

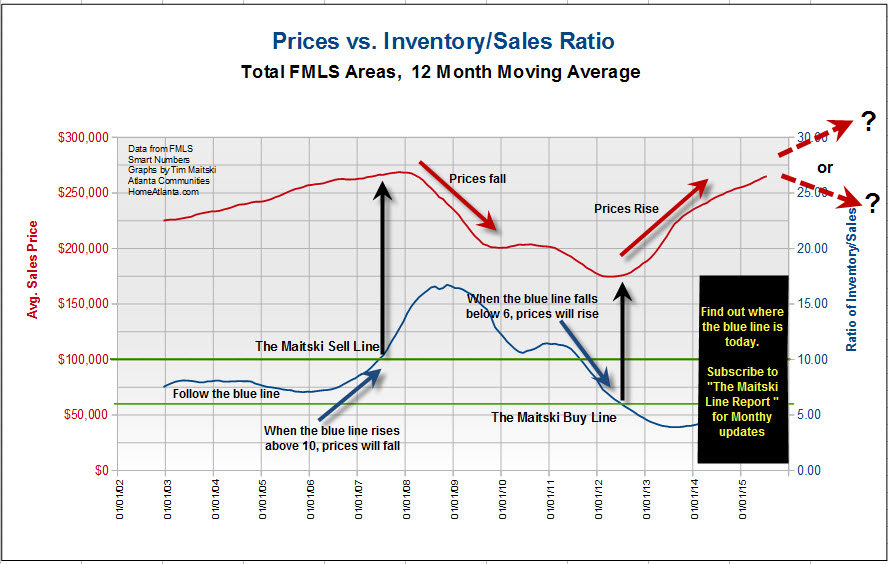

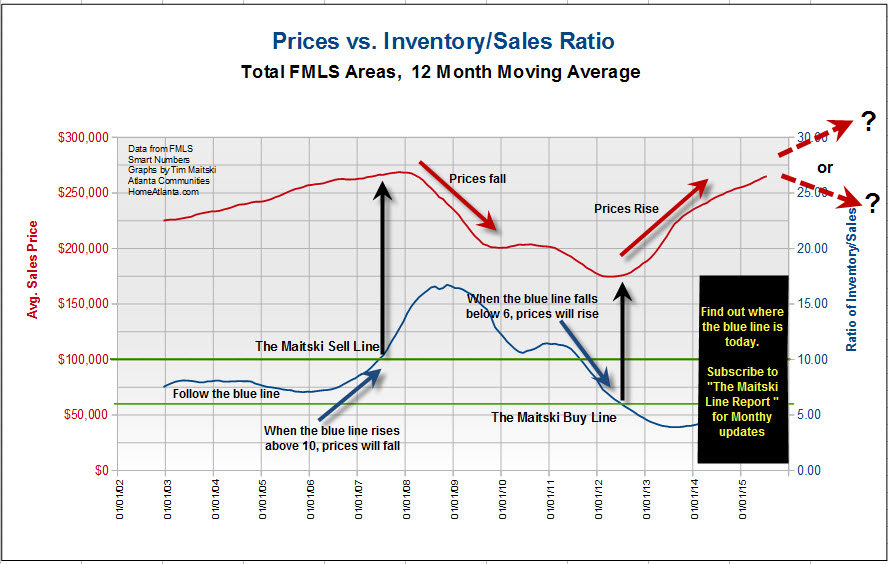

To smooth out the seasonality

noise, I plotted a twelve month moving average. With the chart

below, follow the blue line, the 12 month moving average for the

inventory/sales ratio (absorption rate). A rise to above 10

preceded the start of the fall in prices in 2007. I

call this "The Maitski Sell Line". If you were thinking

of selling, that would have been a great time to get out near the top.

If you were thinking of buying, that would have been a great time to wait

it out and rent instead.

When the blue line fell below 6 in

2012, shortly thereafter

prices increased sharply. I call this "The Maitski Buy Line".

That was the time to buy if you were renting. If you owned a

home and wanted to sell, it might have been a time to wait, if possible,

knowing that prices would eventually go higher.

Of course, past performance is no guarantee of

future performance, but taken along with other statistics, such as

total days on the market, one can have an objective indicator on

which to base a buy/sell decision on. History never repeats

itself exactly but it's worthwhile to study past patterns and apply

them to today's market.

My theory is based on simple economics. When the

supply/demand ratio is outside of its historic channel, prices will

change until that ratio gets back to normal levels.

If the ratio is high, prices will fall.

If the ratio is low, prices will rise.

To find out where the blue line is today, sign

up for the monthly updates in the box below. I not only have

the charts I created for the overall Atlanta area, I have detailed

charts for 37 more localized areas around Atlanta.

Keep Your Transaction Costs to a

Minimum

If you buy a home with me and then

want to sell within one year due to a "Maitski Sell Signal", I will

sell your home for a total of 4.5% commission instead of my

customary 6% commission

Use Us as Your Buyer's Agent

Collect a Rebate for 50% of Our Commission

It's Our "Referral Fee" to You for

Finding Us on the Internet

No Upfront Fees, No Cost to You

Whatsoever |